Experienced traders utilize advanced stock trading techniques and tools for significant portfolio growth, including High-Frequency Trading (HFT). HFT executes massive volumes of trades at lightning speed, exploiting fleeting price differences and trends missed by traditional methods. These innovative strategies maximize returns, manage risk, and generate substantial wealth within dynamic financial markets.

Unleash your trading potential with advanced strategies tailored for experienced investors seeking wealth within. This comprehensive guide explores powerful techniques designed to optimize portfolio growth and preserve long-term wealth. From high-frequency trading’s millisecond advantages to algorithmic models and arbitrage loopholes, we uncover cutting-edge methods. Additionally, learn how adaptive risk parity, stress testing, and tax-efficient strategies ensure your investment journey remains resilient and profitable in dynamic markets.

- Unveiling Advanced Strategies for Optimal Portfolio Growth

- – High-Frequency Trading: Utilizing Millisecond-Scale Opportunities

Unveiling Advanced Strategies for Optimal Portfolio Growth

In the pursuit of unlocking unparalleled portfolio growth, experienced traders often turn to advanced stock trading techniques. These strategies go beyond conventional methods, delving into intricate analysis and innovative approaches to navigate the market’s complexities. By employing sophisticated tools and a deep understanding of market dynamics, investors can identify lucrative opportunities and make informed decisions that contribute to the generation of substantial wealth within.

One such strategy involves dynamic portfolio rebalancing, which ensures that investments align with evolving market conditions. This technique allows traders to capitalize on market trends while managing risk effectively. Additionally, leveraging advanced analytics and machine learning algorithms enables traders to uncover hidden patterns and make predictions, further enhancing their ability to maximize returns and navigate the ever-changing landscape of financial markets.

– High-Frequency Trading: Utilizing Millisecond-Scale Opportunities

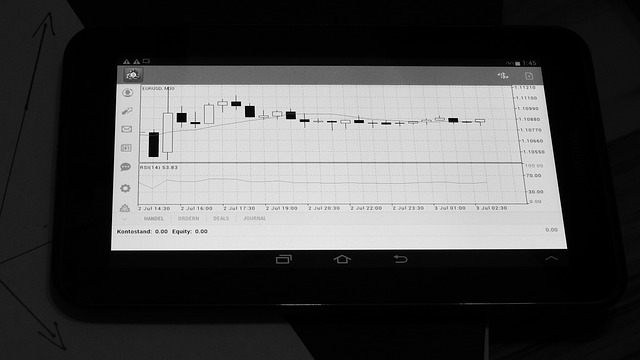

High-Frequency Trading (HFT) is a cutting-edge strategy that has transformed the stock market landscape, particularly for experienced traders seeking to unlock wealth within milliseconds. This advanced technique involves executing a large volume of trades at extremely high speeds, often measuring success in microseconds. HFT algorithms exploit tiny price discrepancies and trends across multiple exchanges, ensuring traders capitalize on fleeting opportunities that traditional methods might miss.

By employing sophisticated software and powerful computing infrastructure, HFT strategies can process vast amounts of market data, identify patterns, and execute trades at lightning speed. This capability is especially lucrative in today’s fast-paced markets, where even a fraction of a second can mean the difference between profit and loss. As such, experienced traders are increasingly adopting HFT to stay ahead, aiming to maximize returns by leveraging technology to capture the elusive wealth within these fleeting market moments.

Experienced traders seeking to unlock the full potential of their investment strategies can leverage advanced techniques like high-frequency trading, capitalizing on millisecond-scale opportunities to drive optimal portfolio growth and achieve greater wealth within. By embracing these cutting-edge approaches, investors can navigate the markets with enhanced precision, making informed decisions in a dynamic environment.